Investing with us

Single Commissioning Framework

The Single Commissioning Framework (SCF) is the bespoke process through which WMCA invests its devolved housing and land funds into housing and regeneration projects through equity, loan and grant.

These funds give investors and developers ready access to housing, land and property development investment to achieve delivery of quality placemaking and inclusive growth, where scheme viability is challenging, or when investment is not readily available elsewhere.

Our process is transparent, robust and efficient with proportionate due diligence and independent viability appraisal at its core, we provide delivery and spend assurance to HM Government and local leaders.

Unlock our funds

WMCA wants to help trusted investors and developers make a mark in the West Midlands. With over £10bn of investable propositions, together we can invest to turn challenging sites into development opportunities.

WMCA has a number of funds available including:

- £100m Housing Deal Land Fund

- £84m Brownfield Land Fund

- £50m Brownfield Land & Property Development Fund (BLPDF)

- £70m Residential Investment Fund (RIF)

- £140m Commercial Investment Fund (CIF)

- Alongside the £250m Housing Infrastructure Fund (HIF)

We continue to seek new funding including:

- £50m Advanced Methods of Construction

(AMC) Fund - £400m Affordable Housing Fund

- £200m Urban Transformation Fund

To receive funding, you must meet:

Developers should have a proven track record of commercial and/or residential development delivery.

WMCA can only intervene as the “funder of last resort” in schemes with demonstrable market failure, defined as: When projects or schemes cannot come forward under existing market conditions without public sector intervention.

Schemes must:

- achieve a target investment rate that averages £10k-£15k per unit

- include a minimum of 20% “Affordable Housing” defined as:

In line with National Planning Policy Framework (NPPF) and/or through a more locally targeted approach to meet a specific need in the relevant local area with the assessment of affordability based upon household income levels in the local area - have demonstrable commitment to AMC

- provide security on investments

- provide clawback and overage provisions

Schemes should:

- adopt a “brownfield first” approach to the development of land

- support the densification at key transport nodes and planned public transport corridors

- support town centre regeneration demonstrate compliance with Inclusive Growth Toolkit

- demonstrate compliance with Regional Design Charter

- demonstrate output apportionment

Funds available

Gap funding to acquire and de-risk sites across the region. The fund ensures housing delivery and will enable 8,000 housing starts by 2031.

Fund specific criteria:

- Schemes must deliver direct housing outputs

- Schemes must obtain a minimum 1.5 Benefit Cost Ratio at project and programme level

- As a gap fund, there are no recoverability requirements

- Both acquisition and investment schemes are permitted

Case study: Port Loop development

More than £4 million is being invested by WMCA to clean up and unlock acres of brownfield land at Icknield Port Loop in Edgbaston.

The funding paves the way for over 300 homes to be built and unlocked using cutting edge construction technology.

At least 20% of these homes will be affordable under WMCA’s unique definition of affordability.

Gap funding to accelerate and de-risk sites across the region through land acquisition and assembly. The fund enables brownfield housing delivery to secure 7,500 homes.

Fund specific criteria:

- Schemes must deliver direct housing outputs

- A percentage of funding can be used to support employment

- Schemes must secure a Benefit Cost Ratio of more than 1.0

- Homes must start on site by March 2025

- Schemes must be in “areas” where a Local Plan is in place or soon to be in place

- As a gap fund, there are no recoverability requirements

- Both acquisition and investment schemes are permitted

Employment land grant funding available to secure 1,600 new jobs, 800 houses and develop 200,000sqm of commercial floorspace.

Case study: Cavendish House

Cavendish House blighted Dudley’s skyline for years. But with the support of WMCA, Cavendish House has now been demolished to pave the way for the wider £82m Portersfield development featuring retail, leisure and housing.

A revolving loan fund targeted at schemes that accelerate the delivery of residential housing on brownfield regeneration sites.

The RIF offers funding on flexible senior debt terms, however mezzanine, equity or joint venture terms may also be considered.

All projects will be secured with appropriate financial return being aligned to risk, return being secured on conventional terms or deferred in line with developer exit.

Fund specific criteria:

- Funding available for residential and mixed-use schemes where residential is largest element

- Minimum scheme size of 10 units

- Maximum funding of £10m per scheme (by exception schemes up to £20m may be considered)

- Maximum repayment term 4 years

- Schemes must be capable of making a commercial return to repay the loan

A revolving commercial development loan fund providing developers and land owners with access to capital for sustainable commercial and industrial regeneration opportunities.

The CIF offers funding on senior debt terms with some flexibility to provide mezzanine or equity funding.

All projects will be secured with appropriate financial return being aligned to risk, return being secured on conventional terms or deferred in line with developer exit.

Fund specific criteria:

- Funding available for most commercial development (including refurbishment of void space) providing good economic outputs are demonstrated

- Maximum funding of £10m per scheme (by exception, schemes up to £20m may be considered)

- Maximum repayment term of 4 years

- Schemes must be capable of making a commercial return to repay loan

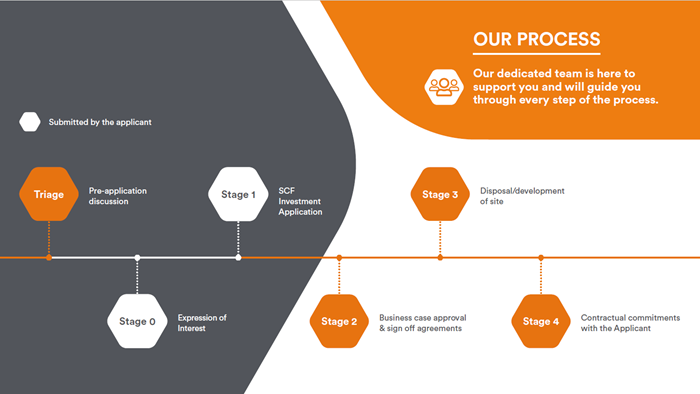

Triage - Pre-application discussion

Stage 0 - Expression of Interest

Stage 1 - SCF Investment Application

Stage 2 - Business case approval & sign off agreements

Stage 3 - Disposal/development of site

Stage 4 - Contractual commitments with the applicant

Get in touch

The Housing & Regeneration team is available to help you through every step of the process, to overcome barriers to delivery and bring forward new and exciting development and regeneration opportunities.

To request a pre-application discussion, contact:

invest@wmca.org.uk.