Making Level 3 study affordable: reviewing the low wage threshold

The WMCA Skills Programmes Funding Rules include a low wage threshold which allows flexibility to fully-fund employed residents who would normally be co-funded, for study at level 3. At present, residents must earn less than £19,350 (£9.90 per hour) to meet the threshold. This is based on the current real living wage rate for those aged 23 or over, though this has been applied to learners of all ages.

This is broadly comparable with other Combined Authorities, where the low wage threshold is currently set around £18-21k. The exception is Tees Valley who have recently set their threshold at £27k – reflecting the median full-time salary in the area – in an effort to raise skills levels, stimulate demand for training and meet employer skills needs at a local level.

Since devolution, WMCA have increased the low wage threshold annually in line with increases in the real living wage. In September 2022, the Living Wage Foundation announced a 10% increase in the real living wage to £10.90 per hour, prompting a further review of our low wage threshold.

Feedback from providers has also indicated that the current threshold is not fit for purpose in the current economic climate and is limiting potential demand for level 3 provision among residents:

a. In the context of rising cost of living pressures, residents who earn above the real living wage but are still on relatively low incomes are increasingly unable to afford to invest in training that will help them to improve their earnings. Faced with greater job insecurity, they can also be reluctant to take out an adult learner loan to finance their training.

b. High levels of labour market demand in some of the region’s key sectors – such as construction - has resulted in pay increases for semi-skilled workers that take them above the real living wage. While this is of immediate financial benefit, it means they are no longer able to access fully-funded training courses to develop the skills needed for further progression.

c. The West Midlands economy has changed significantly in recent years and will continue to do so as advances in technology, automation, the move to net zero, and wider economic challenges reshape employer demand for skills. A key area of focus of our AEB Strategy is to support adults who are already in work to reskill in response to these changes. However, the current low wage threshold is deterring some residents who would otherwise be keen to fill skills and labour shortages, by pricing them out of retraining.

d. Over the past year, WMCA have sought to develop a leadership and management offer to support in-work progression for residents and improve productivity within small and medium sized businesses. Many of those most likely to benefit from this offer are on below average wages but earning above the real living wage. The current threshold limits opportunity for these residents and reduces the financial viability of the provision that we are seeking to build.

Adjusting our low wage threshold in line with the updated real living wage of £10.90 per hour, would increase the threshold to £21,255 per annum. However, we do not think this scale of increase would address the challenges outlined above, nor would it deliver the step change needed to deliver on our ambitions for the region.

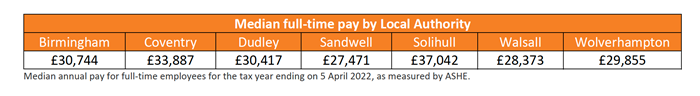

We are therefore proposing to set our low wage threshold at £30k, just below the median pay for full-time jobs across the WMCA area (£30,634). We believe this would reflect a bold commitment to tackling low pay and supporting in-work progression across the region. It would ensure that residents on lower-than-average incomes are not priced out of opportunities to upskill or retrain. It would raise the profile of the region and would signal to central government, to businesses and to residents our commitment to developing a high-skill, high-wage economy.

Furthermore, because median pay varies by local authority, setting the low wage threshold around the WMCA median would serve to focus skills investment in those authorities and wards with a greater prevalence of low pay. It would also focus investment on groups who are more likely to be low paid – including women, ethnic minorities, people with disabilities and health conditions, carers, care leavers, ex-offenders etc. The majority of UC in-work claimants would also be eligible for fee remission, supporting them to increase their income and move off benefits.

We propose trialling the £30k low wage threshold for an initial two-year period, during which we would evaluate its impact on learners, on providers and on our wider adult skills offer.

As an alternative to our current proposal, we also considered a more targeted increase in the low-wage threshold – for certain groups of people, places, qualifications or sectors etc. However, while we recognise that this could reduce the risk of ‘deadweight’ and provide greater focus additional investment, we also believe it would make messaging more complex and would likely reduce overall impact. We therefore decided against a more targeted proposal.