Healthcare technology company becomes first business to receive investment from new West Midlands Co-Investment Fund

Published: Thursday 13 Jul 2023

A Birmingham-based healthcare technology company has become the first business to receive investment from the West Midlands Co-Investment Fund – set up to expand and grow the region’s industries of the future.

Medmin Group Ltd (Medmin) has secured £250,000 from the fund which has been set up by the West Midlands Combined Authority (WMCA) and the West Midlands Pension Fund to provide innovative SMEs with equity of up to £1m matched on a 1:1 basis by private co-investment.

The funding is part of a wider £750,000 investment into Medmin with a further £500,000 coming from the Midlands Engine Investment Fund (MEIF) through the MEIF West Midlands Equity Fund. Both funds are managed by Midven, part of the Future Planet Capital Group.

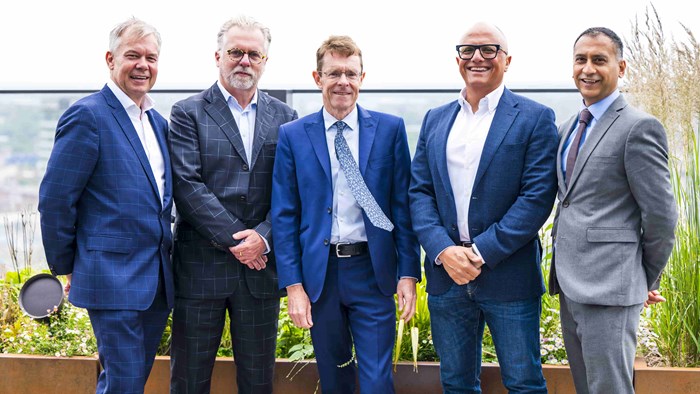

left to right: Rupert Lyle (WMCIF Fund Manager at Midven), Keith Duddy (CEO of Medmin), Andy Street, Mike Yiannis (CFO of Medmin), Surjit Kooner (Director at Midven)

The capital will help Medmin address the growing demand for self-pay private elective surgery, and help them in their mission to transform private healthcare. It will see the company create 60 new jobs over the next three years.

Medmin will also use the investment to complete the technology platform that supports Get Well Soon (GWS), their customer facing brand. This will ultimately facilitate the expansion of clinics beyond the Midlands, forming additional regional clusters to serve the wider UK market.

Medmin aims to transform the provision of private surgery to self-pay patients in the UK by addressing two crucial market dynamics - the growing demand from patients for private treatments amidst post-pandemic NHS waiting lists, and the increasing need from clinicians for a different way of working in the private sector.

Figures reported in April 2023 showed around 7.4million people waiting for treatment. To help combat the long waiting lists, GWS offers a fast concierge-style service for self-pay patients and provides a viable and affordable alternative for elective surgery.

Medmin is also developing a network of specialist clinics in partnership with consultants which includes a total practice management solution for doctors operating in the private sector. The services offered include patient registration, administration, billing, legal, marketing, business management and indemnity insurance cover.

Andy Street, Mayor of the West Midlands and WMCA chair, said: “When the West Midlands Co-Investment Fund was established, I wanted to see us find and fund great local entrepreneurial teams.

“So it’s great to see this first investment into Medmin - an innovative health-tech start up with high growth potential. This £250k investment has been matched with private co-investment and the Midlands Engine Investment Fund have also contributed to this investment round. This backing will enable the firm to scale its operations - at the same time as creating jobs within our region which is an important part of powering our regional recovery.”

Keith Duddy, CEO at Medmin, said: "We are delighted to be working with Midven, the Midlands Engine Investment Fund and the West Midlands Co-Investment Fund.

“Our business started here in Birmingham, and is very much rooted in the region. This funding will allow us to scale up operations, recruit more staff and continue to develop the business. We are grateful that Midven took the time to understand, appreciate and support our exciting plans for the business as we move forward in our mission to uncomplicate healthcare."

The West Midlands Co-Investment Fund looks to invest in SMEs across a variety of sectors including green technology, advanced manufacturing, life sciences and creative and digital, helping them to scale up operations. The WMCA has put £12.5m into the fund and this has been matched by the West Midlands Pension Fund. Operating over a 10-year period, the fund focuses on bringing new private investor money to the region and, using a co-investment model, invest alongside business angels and other private sector investors on a minimum £1 to £1 basis.

Surjit Kooner, investment director at Midven, said: “Medmin offers an exciting opportunity to disrupt the provision of elective private surgery in the UK. Their technology and expertise puts them in a fantastic position to transform private healthcare and we are excited that our investment will help make this possible.”

Mark Wilcockson, senior investment manager at the British Business Bank, added: “The Midlands Engine Investment Fund invests in innovative SMEs across the Midlands. Medmin is a leader in the private healthcare sector with its cutting edge technology, and this funding will support the company’s presence across the UK by creating 60 new jobs.

“This investment is a good example of how the MEIF supports companies based in the Midlands to create a wider positive economic impact on the region’s economy.”

The Midlands Engine Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

Further enquiries

For all other enquiries from members of the public go to our contact us page: https://www.wmca.org.uk/contact-us/